Reinforce Your Tradition With Expert Depend On Foundation Solutions

In the world of tradition preparation, the relevance of establishing a strong structure can not be overstated. Specialist count on structure services supply a durable framework that can protect your assets and guarantee your dreams are executed specifically as intended. From minimizing tax obligation obligations to choosing a trustee that can properly handle your affairs, there are critical considerations that demand interest. The intricacies involved in trust structures demand a critical strategy that aligns with your long-term goals and worths (trust foundations). As we explore the nuances of trust fund foundation options, we reveal the crucial elements that can fortify your legacy and supply a lasting influence for generations ahead.

Benefits of Count On Foundation Solutions

Trust fund foundation services use a durable framework for securing possessions and guaranteeing lasting financial protection for individuals and companies alike. Among the key advantages of trust foundation remedies is property protection. By developing a depend on, individuals can shield their properties from prospective dangers such as lawsuits, financial institutions, or unanticipated economic responsibilities. This defense ensures that the possessions held within the count on continue to be protected and can be passed on to future generations according to the individual's wishes.

Via depends on, people can detail just how their assets should be taken care of and dispersed upon their passing away. Depends on also use privacy advantages, as assets held within a trust fund are not subject to probate, which is a public and commonly lengthy legal process.

Sorts Of Counts On for Legacy Planning

When thinking about legacy preparation, a crucial facet involves exploring various kinds of lawful tools developed to protect and distribute assets efficiently. One usual type of count on utilized in legacy planning is a revocable living trust. This trust allows people to keep control over their properties during their life time while making certain a smooth transition of these assets to beneficiaries upon their passing away, staying clear of the probate process and giving personal privacy to the family.

An additional type is an unalterable depend on, which can not be altered or revoked as soon as established. This count on supplies potential tax obligation advantages and secures properties from creditors. Charitable counts on are likewise preferred for people aiming to support a reason while preserving a stream of revenue on their own or their recipients. Special demands trust funds are vital for people with impairments to ensure they receive necessary care and support without threatening government benefits.

Comprehending the different kinds of depends on readily available for tradition planning is essential in establishing a detailed strategy that lines up with specific objectives and concerns.

Selecting the Right Trustee

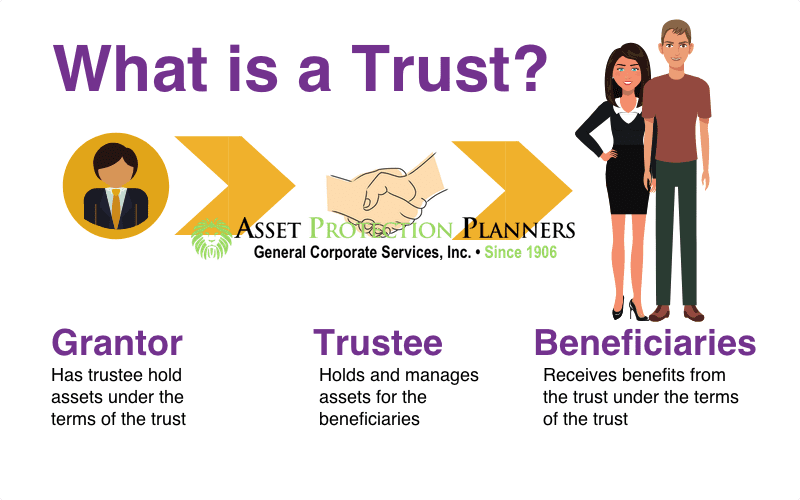

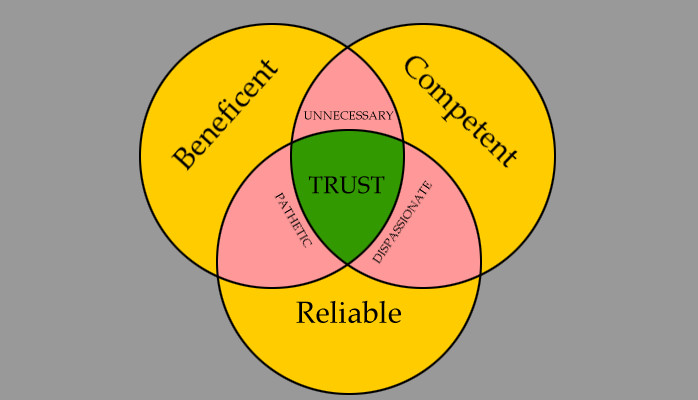

In the world of heritage preparation, a vital element that requires cautious consideration is the option of an appropriate individual to satisfy the critical duty of trustee. Picking the best trustee is a choice that can considerably impact the successful execution of a depend on and the gratification of the grantor's desires. When picking a trustee, it is important to focus on top qualities such as credibility, economic acumen, honesty, and a dedication to acting in the best interests of the recipients.

Ideally, the selected trustee needs to have a strong understanding of monetary matters, be qualified of making audio investment decisions, and have the capacity to navigate complex legal and tax needs. Additionally, efficient interaction abilities, focus to information, and a determination to act impartially are additionally crucial our website characteristics for a trustee to possess. It is advisable to choose a person who is trustworthy, liable, and with the ability of fulfilling the duties and responsibilities connected with the duty of trustee. By carefully thinking about these aspects and choosing a trustee who aligns with the worths and goals of the trust, you can help guarantee the long-lasting success and conservation of your tradition.

Tax Effects and Advantages

Considering the fiscal landscape surrounding trust frameworks and estate planning, it is vital to explore the complex realm of tax obligation ramifications and advantages - trust foundations. When establishing a depend on, recognizing the tax effects is crucial for enhancing the advantages and decreasing potential obligations. Trust funds supply different tax advantages relying on their framework and purpose, such as lowering estate tax obligations, revenue taxes, and gift tax obligations

One substantial benefit of specific depend on frameworks is the capability to move properties to recipients with lowered tax effects. For example, unalterable trusts can get rid of possessions from the grantor's estate, potentially lowering estate tax obligation liability. Furthermore, some trusts enable earnings to be distributed to recipients, who might hop over to these guys be in reduced tax obligation braces, causing general tax obligation financial savings for the family members.

Nevertheless, it is important to note that tax obligation legislations are intricate and subject to change, highlighting the necessity of talking to tax obligation experts and estate planning experts to guarantee conformity and take full advantage of the tax obligation benefits of count on structures. Correctly browsing the tax obligation effects of depends on can cause substantial savings and a more efficient transfer of view wide range to future generations.

Actions to Establishing a Trust Fund

The initial step in establishing a trust is to plainly define the objective of the trust fund and the properties that will certainly be consisted of. Next, it is critical to select the kind of count on that ideal lines up with your goals, whether it be a revocable trust fund, irrevocable count on, or living depend on.

Verdict

In conclusion, establishing a trust fund structure can give many benefits for heritage preparation, including asset defense, control over circulation, and tax benefits. By choosing the ideal kind of count on and trustee, people can secure their assets and ensure their desires are carried out according to their needs. Recognizing the tax ramifications and taking the essential actions to develop a trust fund can assist strengthen your tradition for future generations.